Metal roofing is also an environmentally friendly option. Most metal roofs are made from recycled materials and are fully recyclable at the end of their lifespan. By choosing aluminum sheet metal or corrugated metal, you make a sustainable choice that helps reduce landfill waste and promotes environmental conservation.

Easy Maintenance

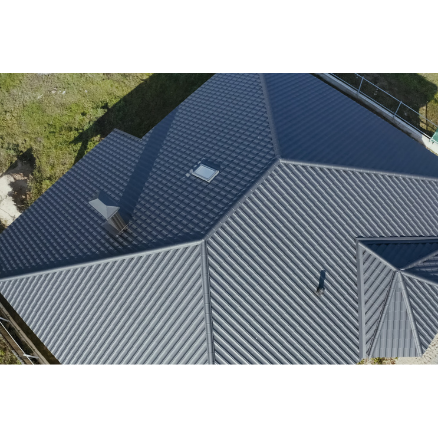

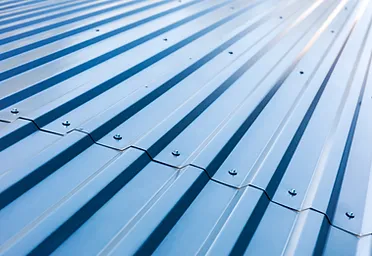

Say goodbye to frequent repairs and replacements. Metal roofs require minimal upkeep compared to asphalt shingles. With the help of Swordsmen Roofing, maintaining your roof becomes a hassle-free experience. Regular inspections and simple cleaning are all that’s needed to keep your metal roof in top condition.

Peace of Mind

Investing in a metal roof means investing in peace of mind. Knowing your home is protected from the elements allows you to focus on what truly matters – enjoying your life in the beautiful Sunshine State.

Bonus: How to finance your roof.

When considering the cost of a new roof, homeowners often worry about the financial burden. Fortunately, at Swordsmen we have several roof financing options to help ease this stress. One common method is through home improvement loans, which allow you to spread the cost over a long term with manageable monthly payments. However, it’s essential to pay attention to high interest rates, as they can significantly increase the total amount paid over the life of the loan.

Your credit score plays a crucial role in determining the interest rate and approval for these loans. Those with excellent credit can benefit from lower interest rates, while those with bad credit might find their options limited. However, there are personal loan options available specifically designed for individuals with poor credit, though they may come with higher interest rates. Some credit cards offer 0 interest for a promotional period, which can be an attractive option if you can pay off the balance within the specified time frame, such as 12 months. Consulting with a roofing company can provide insights into the best financing options available.

For those who prefer not to take out a loan, leveraging home equity loans can be a viable alternative. These loans use the equity in your home as collateral and often come with lower interest rates compared to unsecured loans. Another option is using a credit card with a low or zero-interest introductory period to pay for a new roof. It’s important to ensure you can repay the amount before the higher interest rates kick in after the promotional period ends. A reputable roofing company can often help navigate these options and find the best solution for your financial situation.

When your roof is damaged, filing insurance claims can sometimes cover the cost of a new roof. It’s essential to understand your policy and work with your insurance company to maximize your benefits. High-quality roofing materials and professional installation by a trusted roofing company can extend the life of your roof and potentially lower your home insurance premiums.

If you’re worried about high costs, some roofing companies offer financing directly to their customers. These in-house financing plans can provide flexible repayment terms tailored to your budget. With a focus on making high-quality roofing accessible, these companies can help you get the high quality roof you need without the immediate financial strain.

Whether you choose a personal loan, home equity loan, or roof financing options through a roofing company, it’s crucial to compare all available options. Understanding the terms, including the repayment period and interest rates, will help you make an informed decision. Remember, investing in a high-quality roof not only protects your home but also adds value to your property.